Dear friends,

Boulder County real estate robustly moved in a positive direction last week.

But first, here’s an uplifting window into the inspiring ways people are quarantining.

Here is our local COVID resources directory.

BOULDER REAL ESTATE MICRO DATA:

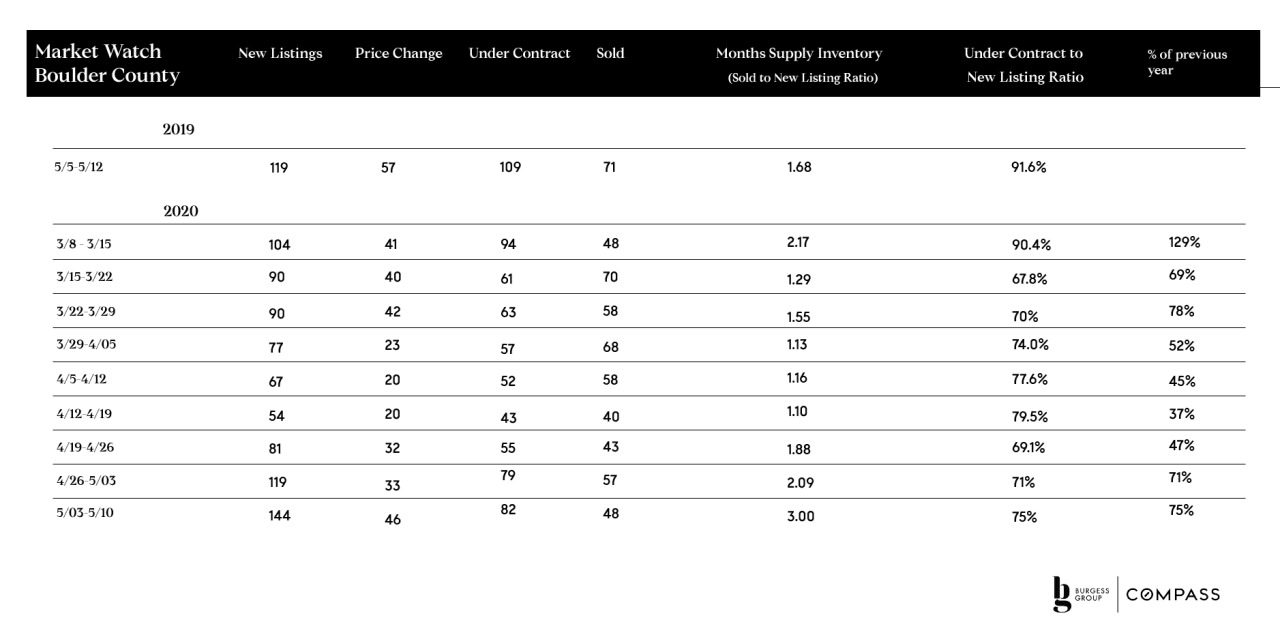

Last week’s data was super positive.

We had 144 listings come to market, compared to 119 during the same window in 2019. Was this a pent-up surge or will this rate of listings continue? Let’s keep track of where inventory is heading week by week.

82 properties went under contract during the last week, giving us a 75% sell-through rate. The same week in 2019 had a 91% sell-through rate; that gap is getting smaller.

To note, on Monday May 11th, 38 properties newly registered as under-contract, which suggests that the sell-through rate this coming week will look extremely strong.

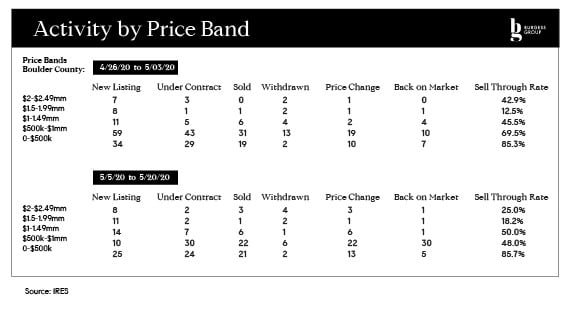

From a price band perspective, the market is balancing across the board.

We saw new listings in every price band, with a huge bump in the $500-1mm range.

Properties went under contract in every price range, with 2 over $2mm, 2 in $1.5-2mm, 7 in $1-1.5mm, 41 in the $500k-1mm, and 41 under contract in the 0-$500k range.

More good changes: price changes are starting to happen, indicating sellers getting serious about selling; withdrawn numbers are dropping; and showing activity is trending up week over week.

We expect these numbers to get even better next week.

Local Real Estate In A Nutshell

Our local market is demonstrating remarkable resilience.

An extreme example of our current market resilience: our $975k listing (below) at 279 Green Meadow, Boulder, had 25 in-person showings from May 7-May 13, and we are still fielding calls on it. With 6 offers, it went under contract substantially above asking price. This demonstrates the current robust demand in the $1mm price point.

MACRO DATA:

Our world is being reimagined. From office space to builders building rental homes to potential home deliquencies, change is on the horizon. Learn more below.

The Office Sector Will Come Back But With Some Changes

Expect changes: higher density downtown companies moving to the suburbs; companies looking for more space to accommodate social distancing; companies using more flex space at companies such as Regus.

More National News

Joe Biden Would Give Homeowners, Renters This Big Break If Elected

As millennials flee coronavirus-ridden cities, JP Morgan teams up with American Homes 4 Rent to build large suburban rental homes.

Mortgage Delinquencies Caused by the Coronavirus Will Exceed Great Recession Levels, According to This Forecast.

Mortgage Rates are Actually Lower This Week

Wishing you health. Call us with questions.

Associate Real Estate Broker

303.301.4718

[email protected]

© Compass 2020 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker and abides by Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to accuracy of any description. All measurements and square footages are approximate. This is not intended to solicit property already listed. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of real estate brokerage.